30 ETH2 Merge Narratives

Random Observation/Comment #764: If you’re in it for the tech and not the economics, then drip savings into ETH and contribute to the ecosystem without worrying about the price.

Why this List?

The Merge is upon us (hopefully early Sept)! I’ve been keeping track of all dev updates through Ben Edgington’s notes and I realized there’s a lot of marketing narratives/buzzwords that are coming with the anticipation of the launch. Here are my favorite and what they mean. Maybe this will turn into a glossary.

At the end of the day, the community is working hard to build a more durable, sustainable and easy to use Ethereum on which creators can confidently innovate.

Note: This is probably more advanced, so this isn’t meant to be a “the merge 101”.

The settlement layer for Web3 – Ethereum is already used as a protocol settlement layer for other L2 networks. It’s like a decentralized central bank working with banking and payment networks to adhere to local regulations and niche use cases. As the base L1 becomes more economical and continues to provide security, the layers inheriting from it will also greatly benefit.

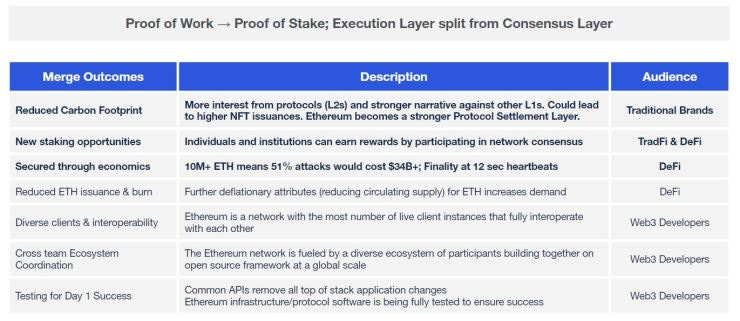

Sustainability through Proof of Stake – From the beginning, Proof of Work was not meant to be the long term solution for the global computer. As usage continued to grow, the urgency for the solution is front and center for the developers and users of the network.

Reduced Carbon Footprint – Turning off Proof of Stake will remove the wasted computation mechanism of Proof of Work for consensus. Fewer computers competing will change the “mining” actors’ participation and reduce energy consumption by ~99.95%.

Democratizing network participation – Instead of big mining companies buying hardware from manufacturers, we are allowing consensus clients to be run on less computationally intensive machines.

Reduced barrier to entry for consensus – The cost to participate in being a single node is actually free. The 32ETH is for staking and receiving rewards equal to the bonding curve calculations.

Staking pools – To reduce barriers of entry, pooling like rocketpool has been used for providing partial ETH beaconchain staking.

Decentralized resilience – More validators and a larger volume of locked/staked ETH means it’s harder to do a 51% attack on the network. Yes, there are issues with Lido have 33%+ staked ETH services, but we’re all trying to diversify distribution to reduce whales.

Sound money – Post-Merge, ETH issuance will be reduced by 90% (reduced amount of tokens created to pay validators) and provides stronger security guarantees for institutional and retail participation

Client diversity and Interoperability – The ETH1 execution clients (e.g. geth, besu, nethermind, etc) and ETH2 consensus clients (e.g. teku, lighthouse, nimbus, etc) all need to interoperate with each other across consistent spec interpretations.

ETH1 ETH2 Modularity – Splitting the compute-intensive execution layer from the consensus layer allows for more focused improvements with parallelization and hierarchical solutions.

Light clients on execution layer – Future implementations and optimizations allow developers to mix and match between client choices. A light client on execution layer may reduce the overhead storage size and lead participants to focus more on heavy weight rewards staking clients.

Cryptoeconomic fault tolerance – The cryptoeconomic designs of Proof of Stake through rewards and penalties/slashing has a deeper link to ETH’s existing usage and distribution.

Engine API – Common interfaces makes sure no API changes are needed for day one compatibility

Reduced uncertainty with predictable blocks – Block times will be on a 12 second heartbeat rather than the previous mempool management.

Deflationary ETH Impacts – The Merge will constrict the supply of Ether and continue burning tokens collected as transaction fees (instead of passing them along to miners)

Economic Finality – Similar to “cryptoeconomic fault tolerance”, we’re leaning on the value of ETH and its distribution to provide transaction settlement guarantees. It would take 10M+ ETH staked to make any unintended changes to states.

Shanghai Fork in Immediate Roadmap – I’m guessing around 6 months after The Merge would be the Shanghai fork which allows for Staked ETH withdrawals

Short term Roadmap: Rollups and Sharding – The roadmap is still actively growing with the next challenge being the reduction of gas costs through increased throughput. This is done through L2 hierarchical splits of tasks rollups and parallel processing of unrelated tasks through sharding

Medium/Long term Roadmap: Stateless clients with pruned sizes – After gas is reduced the next step is to store less data while maintaining the validity and security of the network

MEV and Fee tips – If you’re staking ETH, you’re still receive liquid ETH rewards credited to a mainnet account controlled by the validator.

ETH staking jump by 50% and then tapering off – Current 4.5% APY returns of beaconchain staking will likely increase to 9-12% with conservative projections based on EVM fees and daily flashbot bribes. The increase in staking rewards will also increase the demand for validators and lead to fewer staking rewards each validator returns.

Testing for Day 1 Success – There’s already a ton of testing happening with the right momentum of actions towards decommissioning testnets and migrating to new services. There will be no downtime of the chain during transition to Proof of Stake

Cross ecosystem coordination – The pictures from the undisclosed location events for building and testing this software is really incredible. These teams are really working hard to successfully launch a lot of complex systems. The compassion behind the open source framework at a global scale is truly inspiring.

Formal Verification and Intentional launches – Even before the code was written, a lot of advanced formal verification techniques were applied to the specifications to align to the newly written code.

BUIDL: Make the tech more important than the economics – If only this could be true. I hate that the open source collaboration is buried by the get-rich-quick easy money scams. We just want to buidl.

ETH “Triple Halving” – ETH’s Inflation rate is set to drop by the equivalent of 3 bitcoin halvings

ETH as an internet bond – As you stake more ETH to receive returns, you’re reducing the circulating supply.

ETH as a commodity – ETH powers the usage of Ethereum as a global computer by executing the changes necessary in the smart contract code. It is a digital oil for operating the network.

From “Eth2” to The Merge – The Merge is the combination of Eth1 (execution layer) and Eth2 (consensus layer) on the same chain. There will not be two distinct separate Ethereum networks.

Measure twice, Merge once – We’re not launching until it’s fully tested and everyone’s ready. I think it’s more vital to be complete than on time (even though both would be the best).

~See Lemons Await the Merge

Originally posted on seelemons.com