30 Streams of Income

Random Observation/Comment #795: Wealth is when your passive income exceeds your expenses. Build wealth generating assets.

Why this List?

I don’t remember where I heard this, but it made an impression – “The average millionaire has 6 forms of income.” If you play the game correctly, the salary keeps you in the rat race, while assets that accrue some revenue and/or appreciates in value would create generational wealth.

I’ve previously written a few relevant posts on the topic or financial freedom and digital legacy

Strategic investment and Portfolio management – My personal investment strategy broken down by percentage and risk weighted levels

Wills, Trusts and Digital legacy – Building for future pass-on of information

30 Communities and your Role – Considering my current engagement with different communities and how much time I want to provide in these industries

30 Non Money Investment Activities – Investing in myself through specific activities

How do I analyze how to invest my time and money?

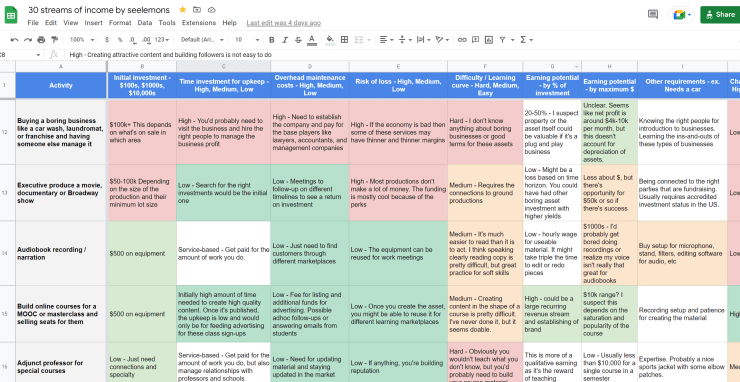

In full analyst fashion, I made a full spreadsheet looking at each stream of income and figuring out these features:

Initial investment – $100s, $1000s, $10,000s

Time investment for upkeep – High, Medium, Low

Overhead maintenance costs – High, Medium, Low

Risk of loss – High, Medium, Low

Difficulty / Learning curve – Hard, Medium, Easy

Earning potential – by % of investment

Earning potential – by maximum $

Other requirements – ex. Needs a car

Chance of success – High, Medium, Low

Full analysis here. Google sheet in all its glory.

I could have done simpler services like gig economy work (Uber driving, Uber eats/post mates, Task Rabbit, etc.) The reason I’m excluding this is because they tend to take up more time and I would rather build an asset with passive income rather than take on more jobs.

Pursuing

Options swing trading based on patterns – I’m going to continue doing this with small 10% bets. The markets seem random and hard to trade right now, but I get some easy wins following some random market movement.

Audiobook recording / narration – I’ll first do this with my own book before recording for someone else.

Build online courses for a MOOC or masterclass and selling seats for them – I’ll be looking to launch one of my courses this year. I have all the material already.

Write a book – My first book “My Life in Lists of 30” was published in 2015. Hey look, it’s in Barnes and Nobles.

Get paid to write the second book – I’ll probably write a separate post on this. There’s so many strategies I can put into action leveraging Web3 that’d be a shame if I just did a self-publishing web2.0 boring thing.

Speak at conferences or for companies (and eventually get paid for it) – I’ve so far spoken at around a dozen conferences. The public recorded ones are on a public YouTube playlist.

Part time consulting work on any of your skills – Now that we have “Wanessa Labs, Inc”, we just need some basic “statement of work” templates and we can start leveraging our freelancing skills with real companies.

Learn Devops configuration and scaling/optimization work and never worry about finding a job – I’m definitely learning the fastest ways to deploy at scale. Check out vercel! It’s never a bad idea to know multiple AWS products and optimizations.

Invest in startups for equity – I tend to only invest in later stage (post-accelerator with promise towards a Series A) startups with a strong trust with the founders.

Join advisory or board of directors for early stage companies or within an incubator/accelerator program – I’m currently conducting the education and consulting workshops for our internal startup advisory practice as well as joined a few other companies as an advisor. Note the advisor role can be carved out to your desired level of detail. Some advisors just show up to a monthly meeting and help make some recommendations or introductions based on their reputation in the industry. Other advisors might be more hands on with delivering a certain proposal or giving feedback on the market approach.

Build and launch VR and AR apps and be first to market – Many people think this will be a flop, but I personally think it’s just cool to develop some of these assets. Launching a “web3” asset like an NFT or new protocol sounds much cooler than what you can tangibly view or show off.

Design and launch an NFT collection inside a DAO – I’ll likely do this for my second book.

General DAO consulting services – Working at Raid Guild is not that hard and mostly part time. I firmly believe you can’t do more than 5 projects at a time.

Don’t Pursue

Buy real estate and pay a company to fix it to flip it – I can barely get my own house fixed. I think this only works if I’m also a handy and competent home owner.

Selling Stock photography or Artwork – I used to do this, but this will be completely replaced by midjourney and AI creation of assets. We will pay for the service and not the specific artwork.

Doing small tasks that might be easy to hire someone else to do (fiverr, Amazon mechanical turk) – I need to do a full analysis of my skillset and what services are requested. I’d look at this like bounties. I’ll only pursue a bounty if I know I can complete it.

Baby sitting or dog sitting – Even though this is manual work, you might get joy in visiting some kiddos and doggies

Flip items from garage sales to sell on eBay – There have been so many times my wife has told me to get rid of something and I wonder “Can I sell that on eBay to recover some loss?” – Long answer short – It’s never worth the overhead and scams.

Flip items from digital marketplaces – Buy from Alibaba and sell to Amazon – you can automate some of these services. See above. I don’t really want to grift and make this world worse.

Joining a poker tour or doing online professional gambling (this can include Draftkings) – I hate gambling and I’m terrible at poker.

Maybe Pursue Later

Building and running a trading bot – I used to run a few trading bots until they got out of control. I may still run one off of LEX algo or something built by chatgpt, but I don’t know if I’ll put a lot of money into it.

Buy real estate and use a property management company to manage it – If interest rates were lower and there wasn’t a looming war, I’d probably be more bullish on this strategy. I personally don’t like being a landlord.

Advertising revenue for your digital medium (e.g. YouTube channel, blog, podcast) – I want to tie this into all of the things I work on so the assets I create are all generating some type of revenue. In order to make sense of this workstream, I really need to just focus on one initiative.

Buy into early stage wait list releases of cars like Tesla Cybertruck and Rivian and then sell into a secondary market – It’s also just cool to have a new car. Unfortunately, the wife doesn’t want to have this as overhead. Agreed that this could be more troublesome and risky than real estate.

Buying a boring business like a car wash, laundromat, or franchise and having someone else manage it – Following Codie Sanchez, I believe she has the right idea on diversified ideas and doing boring things that scale. I also think the market for buying these businesses will be more affordable after a macro meltdown.

Executive produce a movie, documentary or Broadway show – This is more of an illusion of investment in exchange for access. Most documentaries and shows are losses.

Adjunct professor for special courses – I think I’d pursue this after launching the MOOC.

Make websites for existing crappy designed business sites – Honestly, I can probably leverage ChatGPT or some other services to review sites and recommend upgrades. The optimization and flip could all be digital.

Build and launch a mobile app and sell ads – This is also a classic strategy of building assets. A live iOS or Android app on the mobile store could get a few 1000 installs can yield some income. The space is saturated, but there are plenty of games you can own and monetize.

Build and launch a DeFi protocol with tokens – I’ll hold off on launching these types of assets until everything is better classified. I would rather do nothing than take risks.

~See Lemons Build Assets